Accelerating offshore wind through partnerships

28.05.2021 / Lisa Keaton

Offshore wind has a bright future in many countries. The rush of European developers entering the Korean market, like CIP/COP, Ørsted and even oil majors Total and Shell, shows that there is a huge global appetite for offshore wind. A new analysis, looking at the Korean offshore wind market shows how the power of partnerships can enable quicker build-out at a lower cost.

SEIZING THE BENEFITS OF THE RENEWABLE ENERGY TRANSITION

Since it announced the Renewable Energy 3020 Implementation Plan in 2017, South Korea has been working towards generating 20% of its power with renewables by 2030. Among the goals of the plan are 12GW installed offshore wind capacity -an almost 10-fold increase in the 124.5 MW installed today.

This plan targets a win-win combination of combatting climate change, reducing Korea’s dependence on imported fossil fuels and building up a future-proof renewable energy sector.

CHALLENGES OF SCALING NEW OFFSHORE WIND INDUSTRY

Korea is not the only country seeing the benefits of increasing renewable, and offshore wind in particular. The EU is putting offshore wind at the center of its climate strategy and targeting to quadruple the current 12GW to 60GW by 2030 and to 300GW by 2050. Recently, the Biden Administration in the US announced a goal of 30GW offshore wind by 2030 and focused on the capacity of this new industry to help the US middle class bounce back from the job loss of the pandemic.

Goals like these are critical to abating the climate crisis, but building a new offshore wind industry or scaling an existing one brings challenges to any country.

In emerging markets, policymakers often need to clear obstacles in the areas of regulatory, permitting, supply chain and grid in order for offshore wind to take off.

Finally, there is the question of how to ensure that the energy is provided at the lowest possible cost. In the recently published study “Accelerating South Korean Offshore Wind Energy Through Partnerships” we examined these issues in a joint effort between partners Aegir Insights, Pondera Consult and COWI.

KOREA IN A STRONG STARTING POSITION

When the Embassies of Denmark and the Netherlands in Korea approached us with this complex assignment, we decided to take on the challenge. This study required a unique combination of skills: very specific Korean and European knowledge of policy environment and supply chain, a broad commercial perspective on the cost of energy and expertise on job creation.

We found that Korea is in a strong starting position compared to other emerging markets and has already constructed two small offshore wind farms using only domestic supply. These were great achievements, but also revealed weak spots and barriers which must be addressed if Korea is to meet its goals.

Some of the key challenges that Korea will face in domestic supply are related to the wind turbine. Domestic producers Doosan and Unison are currently developing 8MW and 10MW offshore turbine to lessen the competitive gap to the global OEMs. However, with the costs of an offshore wind farm running into the billions of Euros, project owners want to be sure of the turbine technology before using it, so domestic turbines will also need to prove themselves by establishing a track record.

PARTNERSHIPS CAN REDUCE COST OF ENERGY BY 19-22%

The study finds that this major hurdle can be effectively overcome by encouraging global OEMs to enter the Korean market. They bring proven, state-of-the-art wind turbine technology and large production capacities that can jump-start Korean offshore wind. In parallel, Korean manufacturers can establish a track record and increase competitiveness.

Increasing domestic production capacity of the balance of plant supply chain and adding new technologies like XL monopiles is also expected to be a challenge. Specialized installation vessels can dramatically increase installation speed, but are likely to become a bottleneck.

Partnerships between Korean and European companies can also relieve these stresses and at the same time train Korean workers and transfer knowledge.

Partnerships can help Korea build not only faster, but at a lower cost.

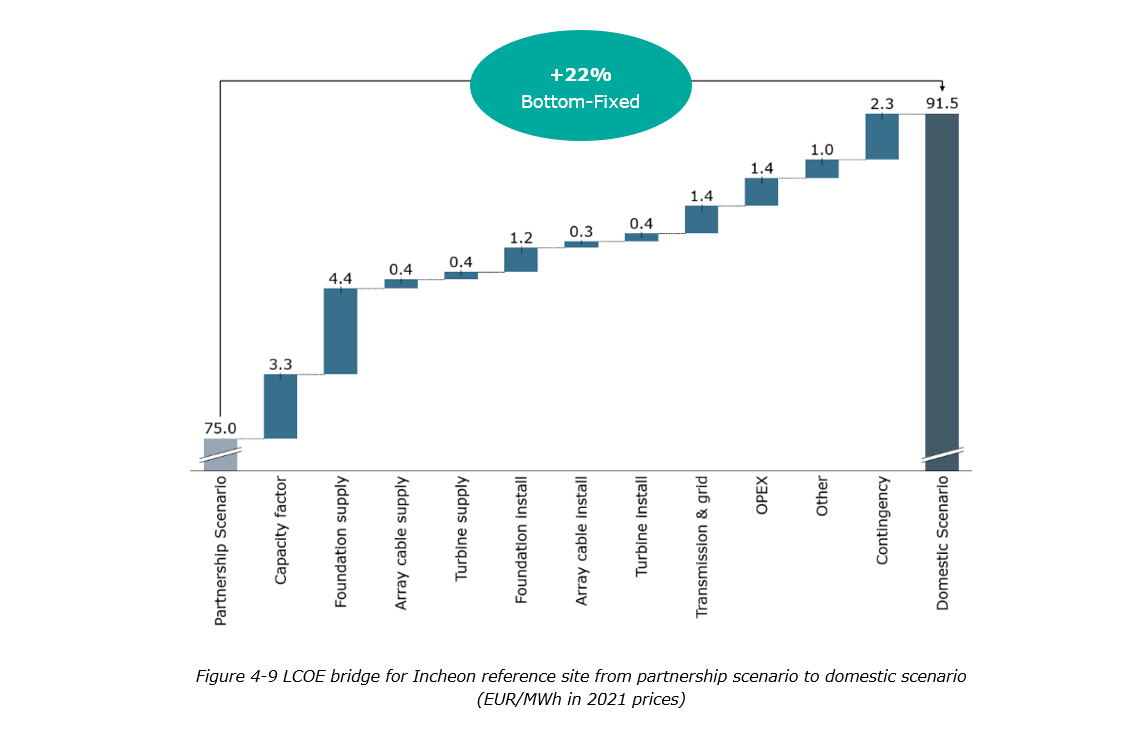

The levelized cost of energy for a floating wind farm built only with the domestic Korean supply chain is estimated to cost 19% more than one built in partnership with global suppliers. For bottom-fixed wind farms, the difference is even more: 22%.

Pondera is already embracing the partnership route in their own company. They have been operating in Korea for several years now with a branch office in Seoul, looking for opportunities to contribute to offshore wind development by sharing expertise and experience gained in offshore wind in Europe. Since Pondera is always looking to collaborate with Korean companies to serve customers, the results of this report underline that this approach is of great added value, Eric Arends, Director and Partner in Pondera says.

LARGE GLOBAL APPETITE FOR OFFSHORE WIND

In general policymakers, investors and advisors are looking to prepare the way for offshore wind using studies on supply chain, barrier mapping, infrastructure assessment and road.

This particular study features a newly-developed tool by Aegir to help developers and policymakers compare levelized cost of energy over large areas. As Rikke Nørgaard, Managing Director of Aegir Insights, notes - the LCOE heat mapping that Aegir performed in this study is a really useful tool in these early stages of offshore wind development because it brings a clear commercial angle to the policy discussions.

The full study can be downloaded here.

ADDITIONAL INFOGRAPHICS

Get in contact

Jan Behrendt Ibsø

Group Senior Market Director

Energy International Management, Denmark

Tel:

+45 41 76 05 47

jbis@cowi.com

Get in contact

Emma Wahlberg-Melvig

Head of Communication, Business Line International

Communication, Denmark

Tel:

+45 56403896

emwa@cowi.com